Individual & Business Owner Advanced Planning Solutions

What we do at Whitney Financial Strategies, LLC is coordinate your personal and business financial planning into such areas as:

The problem most people have is that the financial planning they have done on their own has generally been in a piecemeal manner. They have received different advice from different people, at different times. Regrettably this piecemeal planning inevitably results in hundreds of thousands of dollars, if not millions, going down the drain unnecessarily due to lack of coordination. Most common areas of concern:

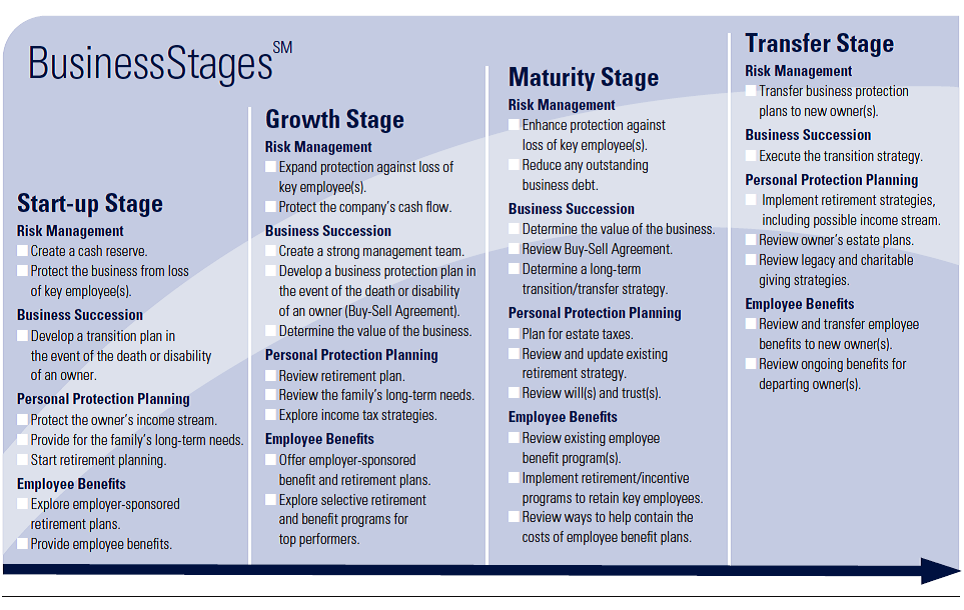

For Business Owners: Financial Planning Saves Time = Money Whitney Financial Strategies, LLC's clients are usually very successful in their businesses and are very active in their lives. Their time is better spent doing what they do best. The clients we work with often have existing relationships with a good group of advisors. Our clients have often done a lot of good planning with these different advisors. They have talked a lot, but for some reason the overall comprehensive plan never seems to get done. It never gets to home plate. The problem is that basically, there is no one on their team who can, or will, be responsible for comprehensively tying it all together in one plan. Comprehensive financial planning is what we excel at. We know our clients are busy. They do not have the time, knowledge, or inclination to do it themselves, which is why they would hire a firm like Whitney Financial Strategies, LLC. It has been our experience that our clients find tremendous value in consulting with our firm for an all-inclusive plan. We can be the member of your team who brings your plan all together, from a holistic standpoint, to ensure there are no gaps. All businesses go through stages much like a child maturing into an adult. In the "Start-up Stage," a business requires a lot of attention and guidance. Without the owner's constant and direct control, it is liable to fall apart and ultimately fail. During the "Growth-Stage," a strong management team is created and the business begins to accelerate success. During the "Maturity-Stage," the business has created some significant value and the business can operate mostly on its own without the direct participation from the owner. At this point, a valuation will likely be required. In the final stage, also known as the "Transfer-Stage," the business owner transfers ownership to a new owner and retirement and estate planning becomes a key focus for the prior owners.

Below is a list of areas in which we provide guidance:

|

Most successful people are so busy being successful that they don't have time to keep on top of all the changes in the tax law and in the financial marketplace. They don't have time to become experts in these areas.

Most successful people are so busy being successful that they don't have time to keep on top of all the changes in the tax law and in the financial marketplace. They don't have time to become experts in these areas.