401(k), Pension, IRA, Brokerage & Overall Wealth Management

From Senior Needs Planning, ©2010 by WebCE, Inc. Used with permission.

From Senior Needs Planning, ©2010 by WebCE, Inc. Used with permission.

The magic number for retirement was once age 65. A person might have enjoyed a pension, a gold watch, and a leisurely retirement that lasted about a decade. Today, retirement looks very different. Longer life expectancies, improved health, and more active lifestyles are shaping a different kind of retirement for many retirees. Some people continue working beyond traditional retirement age, others start new careers, and some cycle in and out of the job market. And, as traditional sources of retirement income—Social Security, defined benefit plans, and retiree health benefits—continue to evolve, so do the challenges facing retirees. The responsibility for ensuring a comfortable, secure retirement now falls squarely on their shoulders. This changing landscape also means that retirement distribution planning has become more important and urgent than ever before. The main challenge—achieving potential lifetime income solutions—is a serious one. Our job as a financial practitioner is to help clients evaluate and strategically plan for retirements that may last almost as long as their working years. This, of course, entails making sure our clients—whether they are younger than age 59½, older than 70½, or somewhere in between—understand and comply with the rules for taking distributions from their qualified plans. In many ways, retirement planning today demands a higher level of attention than ever before. Workers can no longer assume that company pensions will be waiting for them once they turn 65. In fact, it is more likely that they will be responsible for securing their own financial security once they retire. And, as unease grows over the future of Social Security, most American workers must actively plan for their own retirements.This requires making savings and investment decisions that are increasingly diverse and complex. It also requires that individuals create a comprehensive strategy for distributing assets in a way that minimizes taxes and ensures funds accumulate as long as possible on a tax-deferred basis. One additional factor—notably, longer life expectancies—also highlights the need to develop an effective asset distribution strategy that supports a longer retirement. Let's take a look at some factors that are changing the nature of retirement today:

Increased Longevity

Due to advances in medicine and science, Americans today are living longer than ever before. On average, men and women who reach age 65 can expect to live well into their 80s. In fact, the average life expectancy at birth in the United States is currently 78.9 years.1 As the average life expectancy has been increasing, so has the number of elderly individuals in the United States. In fact, the number of people age 65 and older is expected to grow from over 47 million in 2015 to 98 million by 2060, while the 85-and-over age group is estimated to more than double from over 6 million in 2015 to 14.6 million by 2040.2 As the senior population increases—both in number and as a proportion of the overall U.S. population—what impact will this have on the need for distribution planning? First, many people will be spending a greater portion of their lives in retirement and will need to rely more on personal assets to meet the financial needs of retirement. The challenge of paying for a retirement that could last as long as 20 or 30 years—in some cases, almost as long as a person's working life—is daunting. However, it is part of the new retirement reality for many individuals today. The practical financial implications of longer life spans must be incorporated into retirement plans. This means retirees will have to plan for longer (and thus greater) income needs and the possibility that expensive health-care treatment will eventually be needed as they get older. Clients may also be concerned about making their savings last through retirement. Only 18 percent of employees in a recent survey said they were very confident they will have enough money to live comfortably throughout their retirement years.3 While outliving their income is a common fear, there are many ways retirees can reposition assets to provide an income they can rely on for the rest of their lives.

Delayed Retirement and Continued Employment

Although age 65 has traditionally been viewed as “normal” retirement age, around 20 percent of workers plan to retire before reaching this milestone, and another 32 percent intend to retire between ages 65 and 69. Nearly 27 percent of workers anticipate retiring at age 70 or older.4 Another significant trend is that retirement no longer signals a complete end to employment. Many of today's retirees, who are younger and healthier than their counterparts of previous generations, continue to participate in the workforce. In fact, the number of individuals age 55 and older who are in the workforce is expected to grow by 1.8 percent annually, more than three times the rate of growth of the overall labor force. This group's share of the labor force is also anticipated to increase from 21.7 percent in 2014 to nearly 25 percent in 2024.5

Reasons for Continued Work

Why are many people of retirement age continuing to work? Based on a recent survey, workers are postponing retirement for the following reasons:6 wanting to stay active and involved (90 percent)

- wanting money to buy extras (67 percent)

- needing money to make ends meet (42 percent)

- a decrease in savings or investments (23 percent)

- keeping health insurance or other benefits (13 percent)

Of course, some people continue working because they like their jobs, while others shift to part-time jobs or pursue their dreams of entrepreneurship. Some continue to work for nonfinancial reasons, such as wanting to maintain social contact with others and the desire to remain physically and mentally active.

Other factors driving this trend include the following:

- Social Security no longer penalizes workers who earn income after reaching full retirement age.

- Mandatory retirement in the workplace has declined.

- Many occupations are less physically demanding.

- People are living longer and healthier lives.

Decline in Defined Benefit Plans

From the 1930s through the mid-1970s, defined benefit pension plans were the predominant form of private pension plan in the country. These plans, which guarantee lifelong benefit payments at retirement, are based on a worker's salary, age, and years of service. The percentage of preretirement income that a defined benefit plan replaces varies from employer to employer. Generally, the longer a person stays with the same employer, the larger the pension.

Because benefits are linked to a worker's salary level, which presumably will continue to rise, an employee's pension will grow fastest in the final five to ten years on the job. Typically, such plans are designed to replace between 60 and 70 percent of an employee's preretirement income (when combined with Social Security benefits). Most importantly, the responsibility for funding defined benefit plans and ensuring lifetime benefits falls on the employer. However, in recent years there has been a marked shift away from traditional defined benefit pension plans toward self-directed programs that require workers to fund the benefit and assume more of the investment risk. These types of plans—known as defined contribution plans—do not guarantee any specific future benefits and are less complex and expensive to administer than defined benefit plans. The responsibility for any future payout is placed directly on the employee, who decides how much to contribute and directs where funds are invested.

Reasons Behind the Shift

Why have defined benefit plans declined in popularity? Some of the reasons include:

- They are more difficult and costly to administer than defined contribution plans.

- Annual contributions have to be calculated each time they are made.

- Actuaries must periodically review and certify the accuracy of contribution amounts.

- More extensive and expensive compliance and reporting requirements are required than for defined contribution plans.

The amount of future benefits that an employee will actually receive under a defined contribution plan is not currently known. Instead, it will depend on the amount of contributions, plus any income, expenses, gains, losses, and forfeitures associated with a participant's account. The length of time an employee participates and the age at which he or she retires also affect the amount of future benefits the employee will receive.

The shift from defined benefit plans to defined contribution plans means an employee's future financial security depends in large part on what he or she does now. Those who understand the need to plan and start saving at a relatively young age will be in a much better position financially at retirement. And, once retirement arrives, those who understand how to take advantage of rollovers and distribution opportunities from their IRAs and qualified plans will be in a better position to maximize their incomes.

The Uncertainty of Social Security

While almost everyone who is employed or self-employed receives Social Security benefits when they retire, for most, these benefits alone will not be sufficient to support a comfortable retirement. While most financial practitioners estimate that retirees need between 70 and 80 percent of their prior earnings to maintain their standard of living in retirement, Social Security today replaces far less than that—about 40 percent for an average earner at age 65.

And, as the baby boomer generation moves from paying taxes to collecting benefits, the Social Security system is expected to come under increasing strain as the cost to maintain the program will increase dramatically. Starting in 2034, the Old Age, Survivors and Disability Income (OASDI) program is projected to be unable to pay full benefits to beneficiaries.7 A slow-growing economy—leading to fewer workers earning less money on which to pay Social Security taxes—is likely to strain the system further.

Anticipating these problems, Congress has already taken action by increasing the age at which workers can receive full benefits. Without question, other changes are likely as well. Payroll tax increases, benefit reductions, the privatizing of accounts, limits on cost-of-living adjustments, or perhaps a combination of these actions are possible.

What is certain is that the current retirement model, which traditionally relied on employer- and government-provided financial security and entitlement programs, is shifting. The model now focuses more on self-reliance and responsibility for ensuring one's financial future, including the need to ensure that assets are distributed in a tax-efficient manner to help clients meet their retirement goals and needs.

Fewer Employer-Provided Health Plans

Many employers voluntarily provide group health insurance as a benefit to employees, and some also offer these benefits to their retirees. However, as the cost of retiree health benefits has increased in recent years, some employers have passed on a share of these cost increases to their retirees in the form of higher premiums, deductibles, or copayments. Other employers have reduced benefits or stopped offering coverage altogether.

As health care costs continue to rise, it is likely many employers will continue to cut back or eliminate health benefits for retirees. While retirees may purchase coverage on their own—either individual insurance policies for those under 65 or Medicare supplement plans for those 65 or older—individually purchased health insurance can be expensive. In fact, a 65-year-old couple retiring this year is estimated to need approximately $275,000 to cover medical expenses throughout retirement.8Retirees, therefore, need to plan carefully for health care costs, which are likely to be one of their largest expenses in retirement.

All of the changes just noted have had a tremendous impact on retirement planning. While once it was common for workers to look to their employers for lifelong retirement pensions supplemented by Social Security, this is no longer the case. Today, workers are increasingly responsible for ensuring their own financial security.

Chances are your clients probably have saved for retirement over the years through different investment vehicles, such as IRAs or 401(k) plans. Throughout their working lives, their objectives have undoubtedly been to accumulate enough assets to ensure comfortable retirements. However, as retirement nears, a person's focus must shift from accumulating to distributing assets in a manner that matches retirement goals and needs.

Retirement Readiness

How ready are older workers to make the transition from full-time work and accumulating assets to retirement and drawing down assets? According to a recent report, not many are ready for this next phase of life. About 47 percent of workers report total savings and investments (not including the value of a primary residence or defined benefit plan) of less than $25,000. Of these workers, 24 percent have less than $1,000 in savings.9

Among those who have saved for retirement, many older workers simply do not understand the distribution options available or the tax implications of receiving retirement plan payouts.10 In fact, a significant number of plan participants are unable to correctly identify the type of retirement plan they participate in, while a majority are also unaware of the earliest age at which they can receive benefits and the effect that receiving benefits early has on their benefit amount.11

This lack of awareness points to the important role that financial practitioners play in educating clients about the options for taking distributions as well as the tax implications that will impact the ultimate amount of assets available at retirement.

And, as the first wave of baby boomers enters retirement, trillions of dollars in assets currently in retirement accounts will enter liquidation mode. Making mistakes when taking distributions from these accounts can have a dramatic impact on a person's lifestyle during retirement.

Many questions about this phase of the retirement life cycle will undoubtedly arise. For example, how can individuals maximize their incomes during retirement? What options are available for taking distributions from IRAs and qualified plans? And, perhaps most important, how can individuals ensure their retirement savings will provide enough income to last their lifetimes?

During the distribution phase of retirement, the critical question becomes how long a person's assets can support his or her retirement needs. Decisions regarding which assets to tap first and in what order will affect a person's overall financial security for the remainder of his or her life.

Generally, our clients will have three basic sources of personal retirement income:

- currently taxable investments, including savings accounts, corporate bonds, money market accounts, and mutual funds

- tax-deferred investments, including qualified plan accounts, traditional IRAs, 403(b) plans, annuities, stocks, and life insurance cash values

- tax-free investments, including Roth IRAs, designated Roth accounts, and municipal bonds

Different taxation rules apply among these assets. Generally, assets will be taxed at ordinary income rates or capital gains tax rates (some assets, such as Roth IRAs, designated Roth accounts, and municipal bonds, are not taxed when withdrawn). The difference between long-term capital gains tax rates and ordinary income tax rates can be significant. While capital gains rates are subject to change, they are generally lower than ordinary income tax rates.

The question then becomes how can clients tap their nest eggs, and in what order, to minimize taxes, meet expenses, and extend their savings for as long as possible.

The Bucket Strategy

To answer the question regarding the correct order of withdrawing assets, many financial practitioners favor a withdrawal approach known as the bucket strategy. Under this approach, a client divides his or her nest egg into several accounts, or buckets, each targeting a different time horizon, and accordingly, each with a different level of risk. Each bucket is “filled” with the type of investment or investments that support that bucket's time horizon and risk.

Bucket #1

Bucket #1 represents the immediate source of liquid funds from which retirement funds are drawn. This bucket is invested in short-term (one to three years) liquid assets such as CDs, money markets, short-term treasuries, and perhaps a short-term immediate annuity—all low return and low risk.

Bucket #2

Bucket #2 represents a slightly longer time horizon—three to five years, for example—targeting a higher return (perhaps 6 percent to 8 percent) through investments such as short-term bond funds or indexed annuities.

Buckets #3 and #4

Buckets #3 and #4 would be invested for longer periods—10 and 15 or 20 years, for instance—and are funded with targeted mutual funds and more aggressive equity assets. When Bucket #1 is drawn down, the assets in Bucket #2 will have matured and will be available to replace those in Bucket #1. The process repeats, with conversion of assets in each succeeding bucket to those that can be used to produce retirement income.

There are many variations and versions of the bucket strategy. The appropriate plan or approach for any given client will naturally depend on his or her income needs, investment time line, and risk tolerance. The bucket strategy represents a more sophisticated approach to retirement income distribution than simply relying on an annual rate of withdrawal from one's portfolio.

Impact of Taxes on Asset Liquidation Sequence

The assets used to fund the various buckets must be considered, especially if the client's portfolio includes a large proportion of qualified funds. A sound distribution sequencing strategy must account for ways to minimize taxes. While each client's financial situation must be assessed individually, clients are generally advised to:

- withdraw taxable assets first

- draw down tax-deferred accounts next

- withdraw funds from tax-free accounts (Roth IRAs and municipal bonds) last

Importance of Deferring Taxes

Financial experts generally recommend deferring taxes as long as possible. This means if clients have a choice between paying taxes this year or next, they should choose to defer paying taxes. Clients should, therefore, look first to withdraw from accounts or assets that generate taxable gains or income. This strategy gives tax-deferred and tax-free accounts more time to grow unencumbered by taxes, and interest earnings that otherwise would have been taxed remain intact to compound fully. Because the growth of tax-deferred investments is not curbed by taxes, these investments will grow faster than taxable accounts.

Key Point Tapping into taxable assets first is especially of concern for clients under age 59½. These clients will incur a 10 percent penalty charge unless an exception applies, along with income tax if they withdraw funds from tax-deferred assets such as qualified plans or IRAs. |

Clients might also consider selling assets that would net modest capital gains before using tax-deferred assets. For example, the gain on the sale of stock is taxable as a long-term capital gain if the stock has been held for more than one year. In contrast, tax-deferred accounts will be taxed at higher ordinary income tax rates. The savings that may be derived from paying capital gains tax versus ordinary income tax can be quite significant, and the saved income can be used for current income needs or reinvested.

Tapping Tax-Deferred Accounts

After taking withdrawals from taxable accounts, clients should move to tax-deferred accounts next, including traditional IRAs, qualified plans, and annuities. By turning to these accounts only after drawing down taxable investments, our clients have allowed their nest eggs to accumulate more, due to the combination of tax deferral and compounding.

Funds must be withdrawn from traditional IRAs by age 70½, while distributions from qualified plans must begin by the later of age 70½ or when the client retires. Strategies for withdrawing assets must also consider any potential penalty taxes: the premature distribution penalty tax for withdrawing funds before age 59½ and the 50 percent excise tax for failing to take required minimum distributions at age 70½.

Key Point An exception to this general rule of ordering occurs when a client's primary goal is to transfer wealth to succeeding generations. In this case, clients will typically be advised to first consume assets—such as traditional IRAs—that won't receive a step-up in basis at the person's death—before using a capital asset, such as stock, which will avoid income tax when inherited. |

Tapping Tax-Free Accounts

As a general rule, the last assets to be touched in an asset liquidation strategy are those that generate tax-free returns. These include Roth IRAs and municipal bonds. Distributions from Roth IRAs are tax free provided the owner is at least 59½ years old and has owned the account for at least five years. Unlike traditional IRA owners, Roth IRA owners do not have to comply with the minimum distribution rules during their lives. When Roth assets are passed to heirs, withdrawals can be spread out over their lifetimes, which will give their inheritance additional years to grow, tax free. By tapping into Roth IRAs and municipal bonds last, a person receives the most tax-free income.

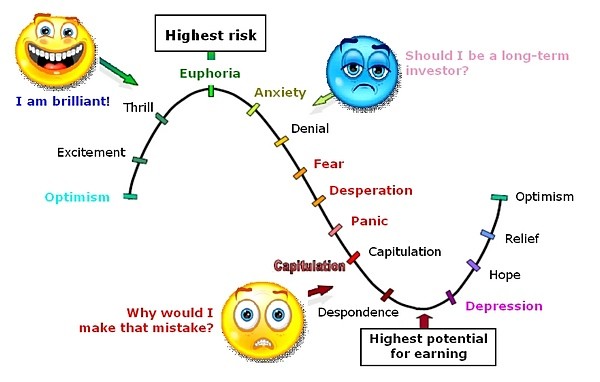

Did you know the average investor consistently underperforms every major asset class in the market?

Underperformance can happen when people invest outside the bounds of their risk tolerance. When the market is up, people often tend to buy and when the market pulls back faster than they expected, fear takes over and they sell, possibly locking in a horrible loss. This fear can cause someone to stay out of the market until it "feels" safe again with the result being that they buy back at an even higher than before.

Of course, it is impossible to nail down 100% of the risk in a portfolio. But if we take out 5% of the risk we cannot control, (Things like 2008 "black swans" which in the financial world refers to things being severely affected by events that are rare and difficult to predict) we end up with 95% of the risk that great advisors actively manage for their clients. Historically, we know that the stock market has trended upward over the long-term, so the goal is to keep your portfolio within your comfort zone while the market moves up and down. You can stay invested and avoid reacting to market downturns, letting the long-term behavior of the markets get you where you need to be.

Great investment advisors use technology in their practices to provide exceptional value to their clients and help their clients break this up and down cycle once and for all. With our state of the art technology, we can help you pinpoint exactly how much risk you can bear and build a portfolio that has a 95% probability of keeping within that comfort zone.

Managed Account Fees:

The Fee Schedule for Managed Accounts is as follows:

The Fee Schedule for Managed Accounts is as follows:

- Up to $1,000,000 is 1.0%

- $1,000,000 to $2,000,000 is 0.75%

- $2,000,000 plus is 0.5%

Note: Fees are based on assets under management. The Fees listed above are quotes on an annual basis. The trustee will deduct fees from accounts under management to be paid to Whitney Financial Strategies, LLC. Fees are properly disclosed on Part 2A of form ADV: disclosure brochure. This brochure is approved by the Texas State Securities Board. Fees will be deducted on a monthly basis based on the average monthly balance (i.e 1% divided by 12 months or 0.083% per month).

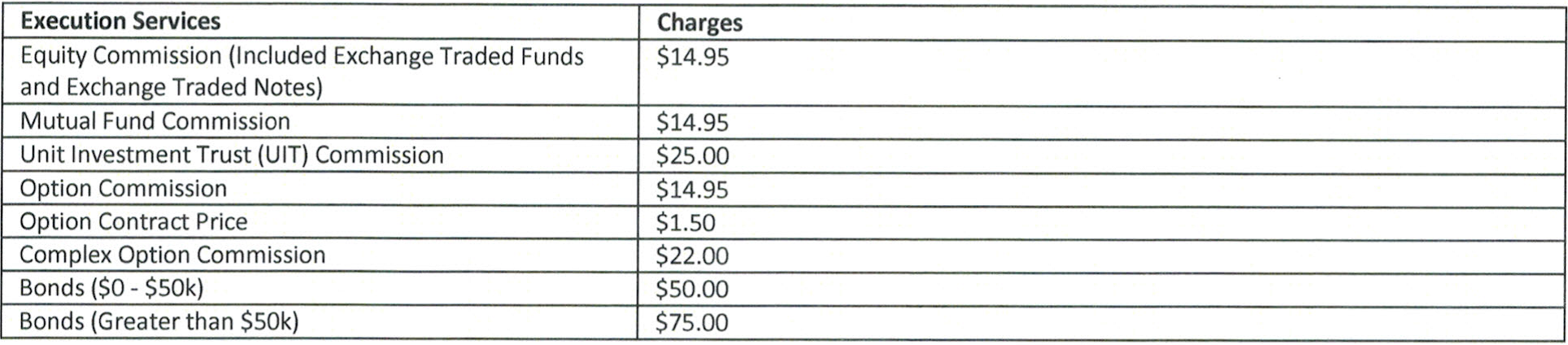

TradePMR our trade execution service provider fees are*:

*Whitney Financial Strategies, LLC does not receive any of these fees. This is how TradePMR is paid for their trade execution and billing services.

The only other fee is a $10 annual fee our trustee clearing firm charges.

Although market timing is very difficult to accomplish with diversified portfolios, at Whitney Financial Strategies, LLC we monitor and measure relative market risk and act proactively as market conditions change with the goal of helping you avoid market corrections. This is especially important for retirees already drawing income from their nest egg when they do not have any guaranteed sources of income other than social security. We will reach out to our clients and suggest a more conservative strategy when the markets are reaching excessive valuation multiples as compared to long-term averages.

Although market timing is very difficult to accomplish with diversified portfolios, at Whitney Financial Strategies, LLC we monitor and measure relative market risk and act proactively as market conditions change with the goal of helping you avoid market corrections. This is especially important for retirees already drawing income from their nest egg when they do not have any guaranteed sources of income other than social security. We will reach out to our clients and suggest a more conservative strategy when the markets are reaching excessive valuation multiples as compared to long-term averages.

For a free portfolio risk analysis click button below:

1 “United States Life Tables, 2014,” National Vital Statistics Reports, Vol. 66, No. 4, August 14, 2017.

2 “A Profile of Older Americans,” Administration on Aging (2016).

3 “The 2017 Retirement Confidence Survey,” Employee Benefit Research Institute, conducted by Matthew Greenwald & Associates, Inc.

4 “Boomer Expectations for Retirement 2017,” Insured Retirement Institute, https://www.myirionline.org/docs/default-source/research/iri_boomers-expectations-for-retirement-2017.pdf.

5 Bureau of Labor Statistics, Labor Force Projections to 2024: The Labor Force Is Growing, But Slowly, December 2015.

6 "The 2017 Retirement Confidence Survey," Employee Benefit Research Institute, conducted by Matthew Greenwald & Associates, Inc.

7 A Summary of the 2017 Annual Social Security and Medicare Trust Fund Reports.

8 “Retirement Benefits Health Care Cost Estimate,” Fidelity Benefits Consulting, 2017.

9 “The 2017 Retirement Confidence Survey,” Employee Benefit Research Institute Issue Brief, conducted by Matthew Greenwald & Associates, Inc.

10 “Employees' Retirement Choices, Perceptions and Understanding: A Review of Selected Survey and Empirical Behavioral Decision-Making Research,” Society of Actuaries, 2014.

11 Ibid.